Medicare Supplemental Plans

Medicare Supplemental insurance plans are designed to work with Medicare. It fills in the “gaps” in Medicare, allowing you to avoid out-of-pocket costs at the doctor or hospital. These plans are sold by private insurance companies and are Federally-standardized. Each company is required to offer coverage off of the Medicare coverage chart.

Before you can understand the coverage supplemental plans offer and compare the options, it may be helpful to understand some basics about Medicare.

Medicare Coverage Briefly Explained – What are the Parts of Medicare and What Do They Cover?

Medicare itself has four parts. “Original” Medicare is comprised of Medicare Parts A & B. You must have both A & B to have any type of Medicare supplemental plan. For a full explanation of the parts of Medicare, refer to our Understanding Medicare page.

- Medicare Part A is the first part of “original” Medicare. It covers inpatient services and hospital services. This part of Medicare is automatically earned through payroll deductions during your working life. You get Medicare Part A (unless on it via disability) when you turn 65.

- Medicare Part B is the second part of “original” Medicare. It covers outpatient services (like labwork, etc.) and doctor’s services. You must sign up for Medicare Part B to get this part of Medicare. It has a $115.40/month premium that is often paid through a Social Security deduction. If you have had Part B before 2011, you may be grandfathered in at a lower premium rate.

- Medicare Part C is also known as Medicare Advantage. This is an optional part of Medicare – if you have a Medicare Supplemental plan, you don’t need a Medicare Advantage plan and vice versa. Medicare Part C actually takes the place of Medicare Parts A & B and all of your health benefits are provided through the private company, which also pays your claims directly to the providers.

- Medicare Part D is the part of Medicare that covers prescription drugs. Keep in mind that NO Medicare Supplemental plans cover prescription drugs. This is always handled through Medicare Part D plans. You can sign up for Medicare Part D through Medicare itself – 1-800-MEDICARE –or by contacting your local pharmacy or an agent that works with Part D.

Medicare does provide relatively comprehensive coverage. If you have ONLY Medicare Parts A & B, you will be covered for most things at 80%. However, it’s the other 20% that causes individuals like you to consider Medicare Supplemental insurance. This 20% “gap” in Medicare is unlimited. In other words, there is no “cap” on your out of pocket expenses. So if you have a procedure or service that costs in the hundreds of thousands of dollars, which is entirely possible, then you would owe 20% of that, if you have only Medicare. This is why the majority of people believe additional insurance is necessary.

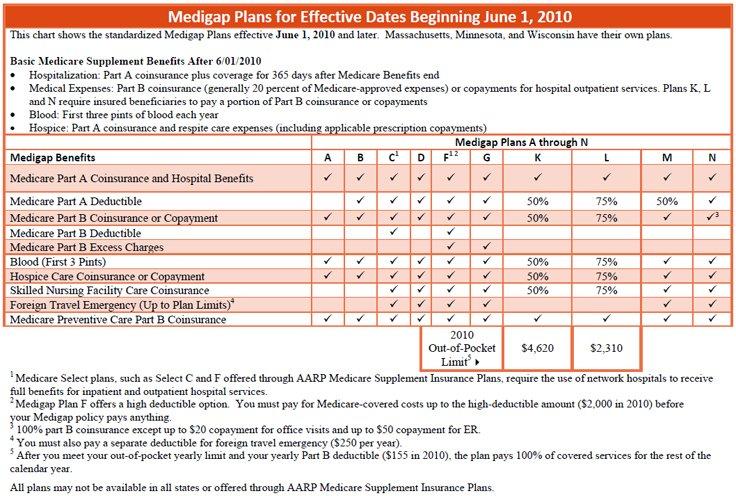

Medigap Coverage Chart

You can view the standardized chart here: Medigap Coverage chart. All companies are required to go by this chart. It allows you to compare “apples to apples” when comparing Medicare supplemental insurance.

In this chart, there are several terms that you may or may not be familiar with. If you have questions about these terms, please contact us and we can help you understand the differences in the standardized plans.

Medicare Supplemental Insurance Plans

The chart above shows the general outline for what each supplemental plan covers. To get further assistance on understanding what the plans cover, you can also visit the plan-specific pages below. Or, if you prefer, you can contact us for more information.

- Medicare Supplement Plan A

- Medicare Supplement Plan B

- Medicare Supplement Plan C

- Medicare Supplement Plan D

- Medicare Supplement Plan F

- Medicare Supplement Plan G

- Medicare Supplement Plan K

- Medicare Supplement Plan L

- Medicare Supplement Plan M

- Medicare Supplement Plan N

Top 10 List – The Top Things You Must Know about Medicare Supplemental Insurance

- Medicare supplements are Federally-standardized.

- They can be used at any doctor/hospital, nationwide, that takes Medicare.

- Coverage does not change once you sign up for the plan.

- NO Medicare supplemental plans cover prescription drugs.

- They are individual policies. If you are married, you and your spouse must have separate policies.

- Plans are “guaranteed renewable”. They cannot be cancelled except for non-payment of premium.

- Medicare supplemental plans do NOT cover routine dental or vision.

- Factors that determine your rate are: age, zip code, gender, tobacco use, and (with some companies) height/weight.

- Medicare Supplemental plans are “portable”. If you move, you don’t necessarily have to change plans.

- Many companies offer “household” discounts for multiple policyholders in the same residence, and some also offer discounts for paying monthly by bank plan.